bucky.

Your financial ally, every step of the way.

Type

End-to-End Design

My Role

UX/UI Design

Industries

Fintech

Duration

5 Months

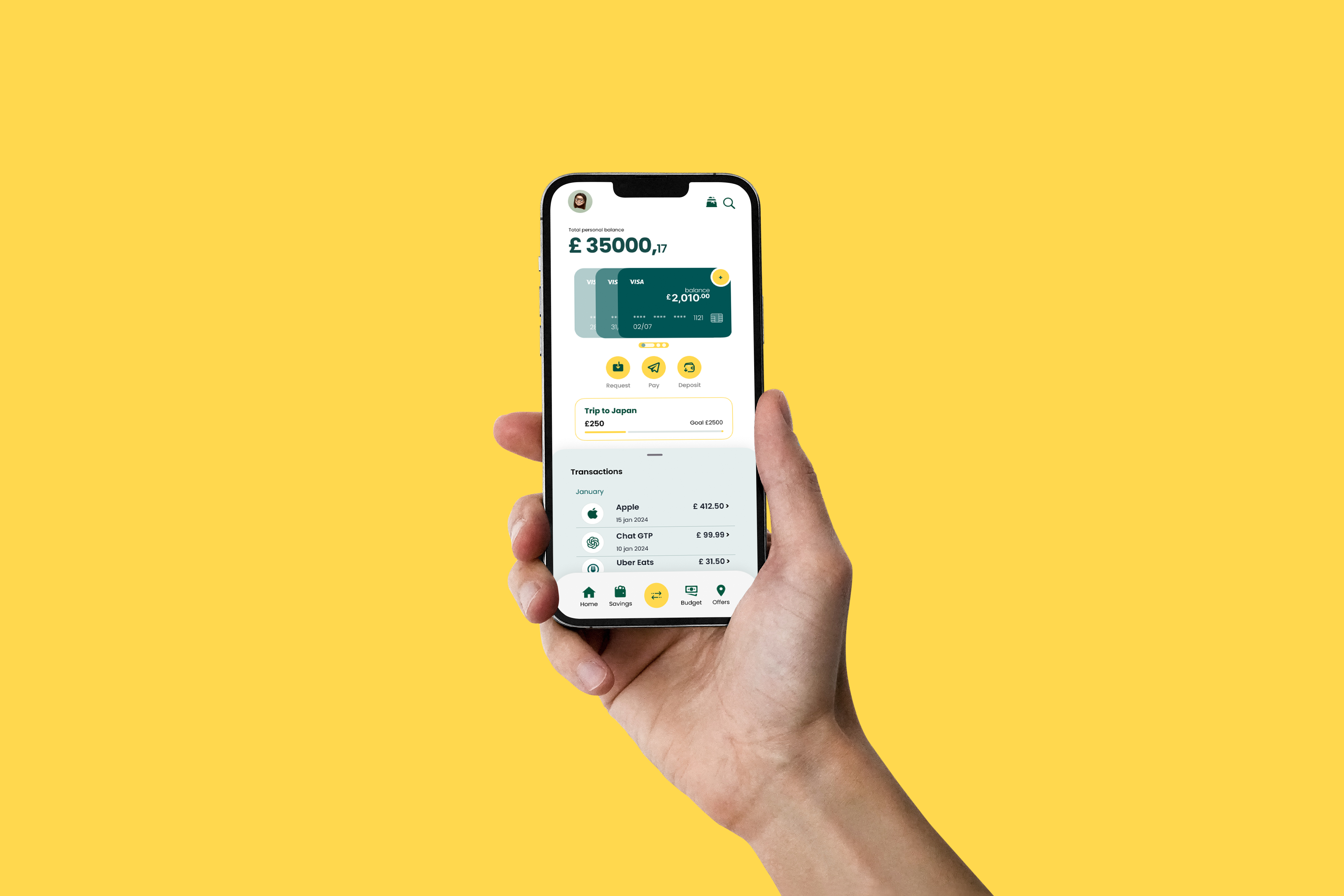

Bucky is a financial management app tailored for those seeking full control over their finances in a fun and engaging way.

Its user-friendly interface provides clear and easy access to financial tools, enhancing budgeting practices and assisting users in achieving their financial objectives.

Design thinking process.

Discover

Research, User Interviews,

Affinity Mapping.

Define

Persona, User Stories, Task Flows.

Develop

Sketching, Wire-framing.

Deliver

Prototyping, User Testing,

Brand Development.

The Challenge

Managing money often brings anxiety and fear, leading to poor financial management, a stressful lifestyle, and dissatisfaction as financial goals remain unmet, ultimately resulting in a lower quality of life.

If poor money behaviour is left unchecked, it can jeopardise long-term goals.

While there is ample access to financial documents, users find the mental effort required to navigate them overwhelming. Consequently, money management feels like a chore, more of a burdensome task than a pathway to an anxiety-free life.

Discover phase.

In the UK, a 2023 survey found that 77% of adults reported feeling anxious or stressed about their financial situation.

Neurodivergent Financial Struggles

30% of neurodivergent individuals in the UK face particular difficulties in financial management related to organisation and impulse control.

Financial Anxiety is Widespread

A survey in the UK revealed that 77% of adults feel anxious or stressed about their financial situation, highlighting the pervasive nature of financial anxiety.

Lack of Financial Literacy = Stress

Nearly 39% of UK adults admit they don’t feel confident managing their money, which contributes significantly to their financial anxiety and dissatisfaction.

Difficulty in Budgeting

48% of people in the UK find it challenging to stick to a budget, leading to financial instability and increased anxiety over their financial future.

Mental Health Impact

36% of individuals with poor financial management experience significant mental health issues due to financial concerns.

Debt is a Major Stressor

Approximately 44% of UK adults report that debt is a major source of stress, affecting their overall quality of life and mental well-being.

User Interviews.

Conversations with users have provided deeper insights into their behaviours and pain points. The findings indicate that despite varying lifestyles and financial circumstances, some common needs emerge.

The need for simplicity.

85% of users seek an app that offers a clear overview of finances without the clutter.

Long term vision.

82% aim for savings and growth, underlining the need for features that boost financial progress.

Motivation is a game.

80% are more likely to save when incentivised with rewards and gamification.

Behaviour

“When I get confused by complicated interfaces in financial apps, I often give up and don’t use them at all.”

Behaviour

“I use Excel to record my expenses and set up a budget, aiming to save money effectively.”

Behaviour

“Saving money feels like a never-ending task; I often withdraw money because I can’t see the endpoint.”

Goal

“I want an app that allows me to easily understand my financial situation without feeling overwhelmed by too many features.”

Goal

“I want to be able to easily track my financial progress and get suggestions on how to improve my savings strategy without manual hassles.”

Goal

“I want to be able to engage with an app that uses gamification to make saving not just beneficial, but also fun and engaging.”

Pain Point

“I dislike financial apps that make me feel lost in their complexity, leading me to abandon attempts to manage my finances digitally.”

Pain Point

“The need for constant manual tracking is exhausting; if I forget to enter expenses for a few days, all my efforts could be in vain.”

Pain Point

“It’s discouraging when saving feels like a chore; I thrive when it’s turned into a rewarding game that keeps my interest piqued.”

Define phase.

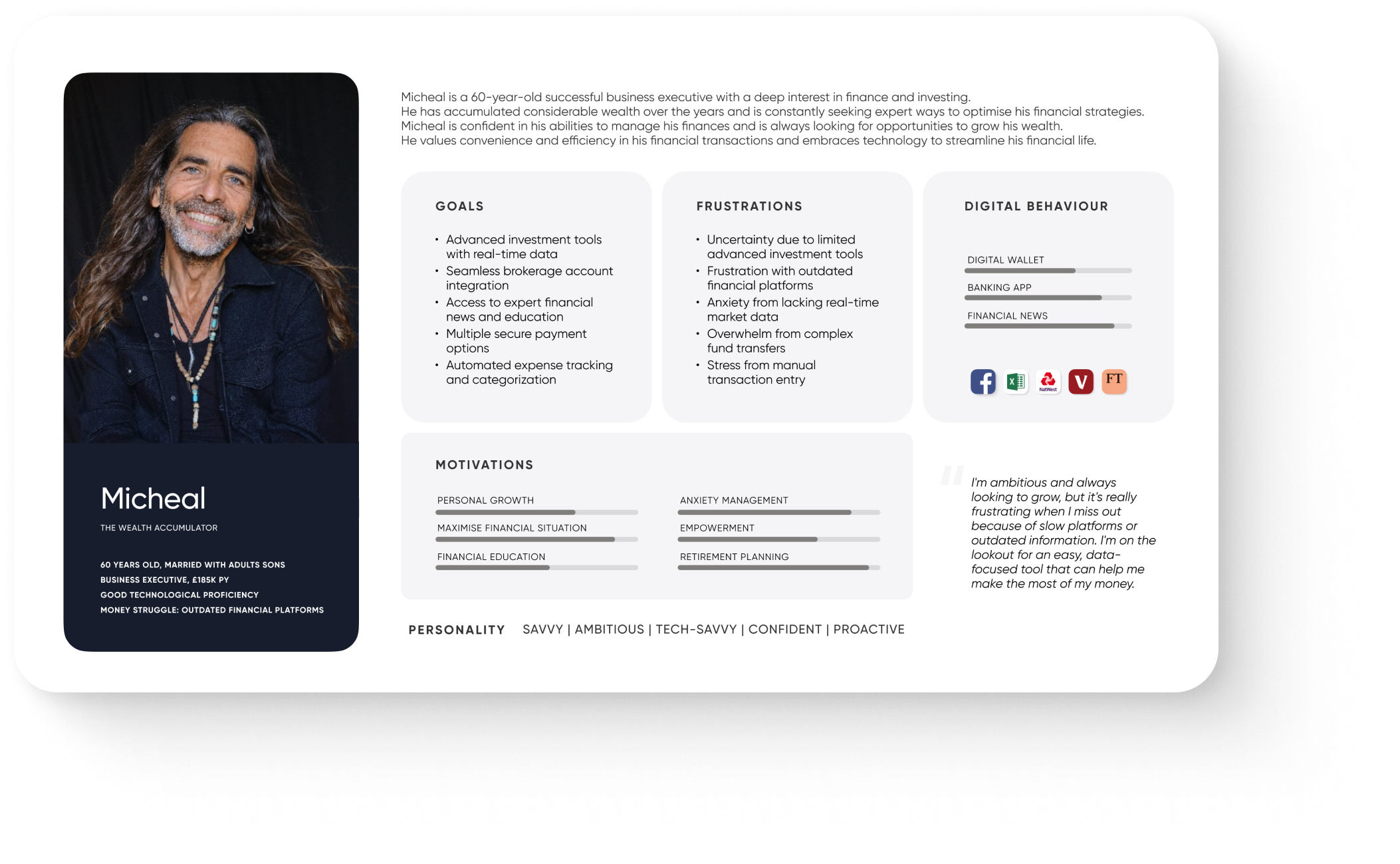

To better understand the goals and pain points of my users, I created persona profiles for Emily and Michael, which helped to consolidate recurring themes.

Guiding question.

How might we help users by creating a financial management tool that simplifies complexity, eases anxiety, and offers reliable advice for confident decision-making?

Think like a user.

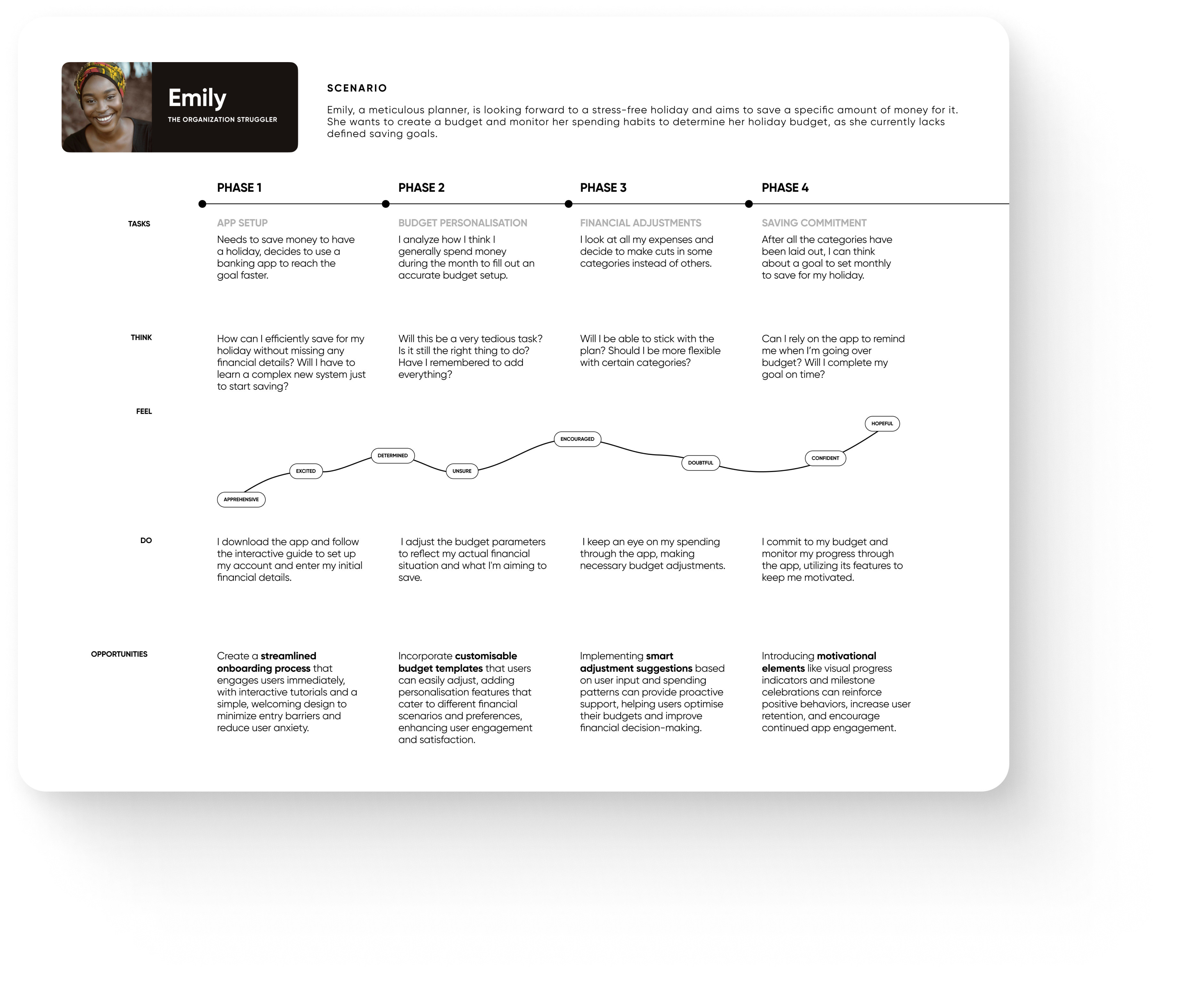

Using the experience map, I closely examined the journey of saving for a holiday, identifying specific areas for design intervention. This analysis allowed me to explore opportunities that could address the “How Might We” questions for users like Emily.

Opportunities.

Thanks to the insights gained from the experience map, I identified three opportunity areas that will enhance the final product for our end user.

![]()

Customisable budget templates.

Incorporate customisable budget templates that users can easily adjust, adding personalisation features that cater to different financial scenarios and preferences, enhancing user engagement and satisfaction.

![]()

Smart Adjustments suggestions.

Implementing smart adjustment suggestions based on user input and spending patterns can provide proactive support, helping users optimise their budgets and improve financial decision-making.

![]()

Visual motivational elements.

Introducing motivational elements like visual progress indicators and milestone celebrations can reinforce positive behaviours, increase user retention, and encourage continued app engagement.

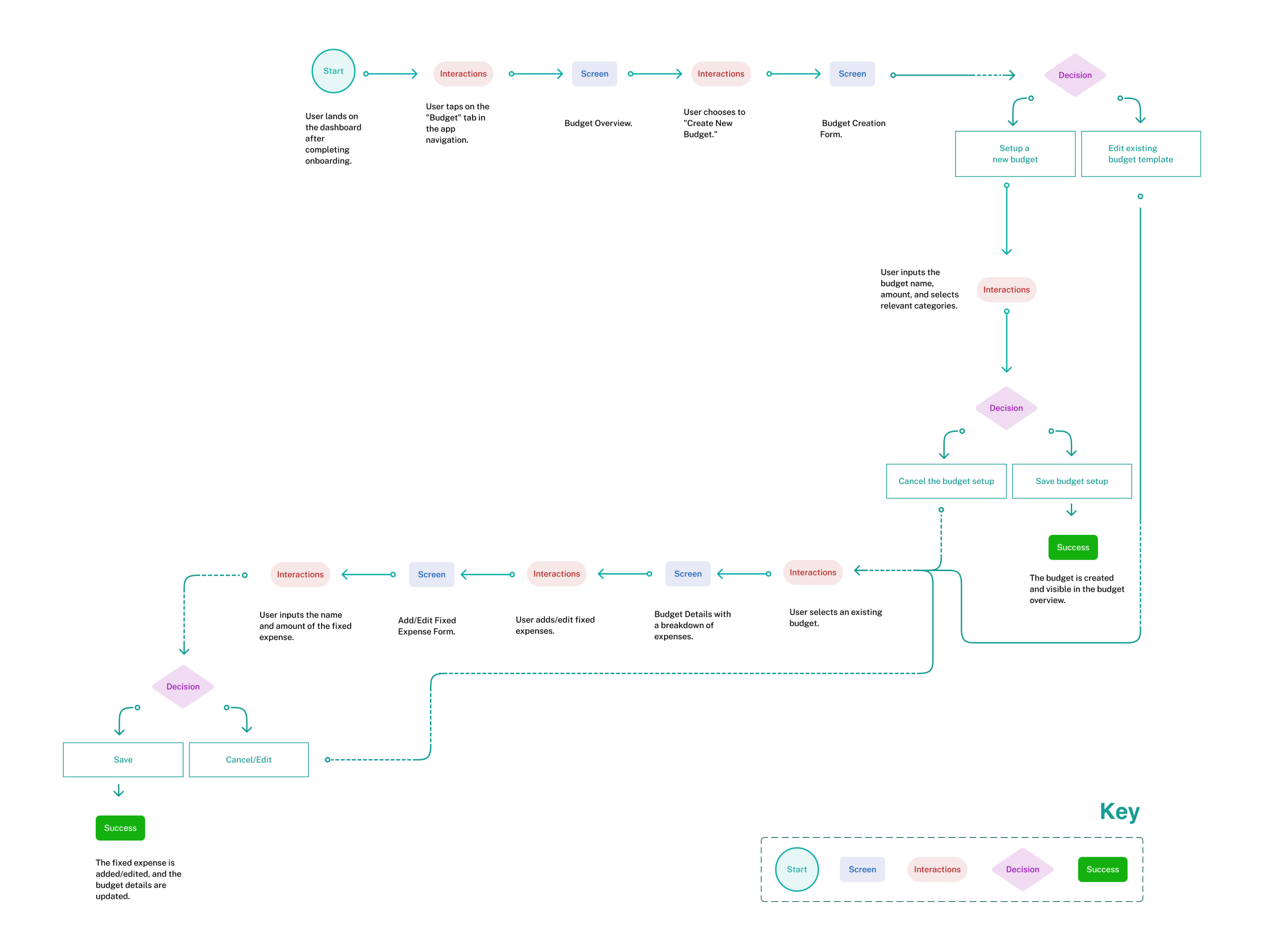

Task flow.

After completing the onboarding, Emily proceeds to create her budget, choosing to start from scratch or modify an existing template. She customsies her categories and, once satisfied, confirms or edits her budget. Upon finalising, she saves it and uses a savings dashboard to track her progress.

Develop phase.

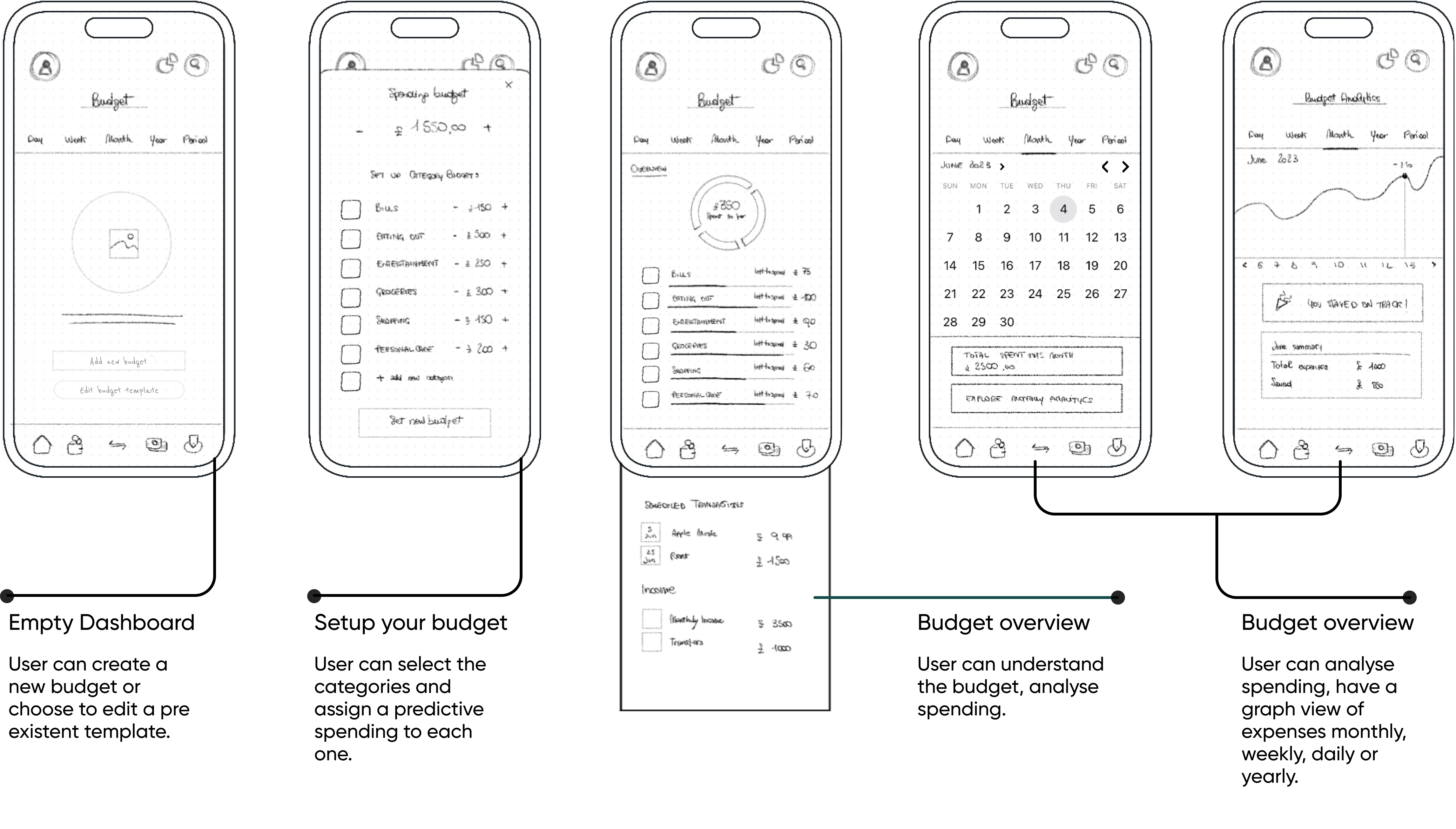

Wireframes

User testing finders.

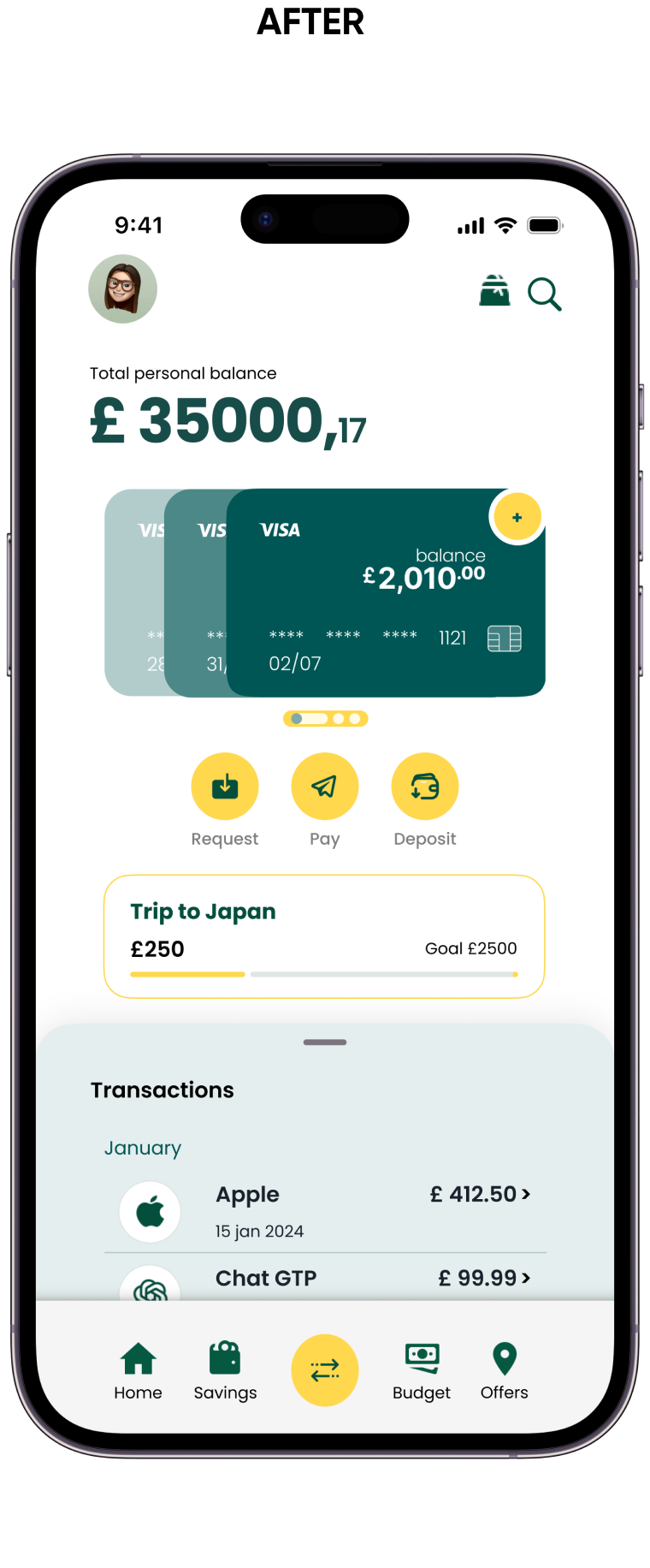

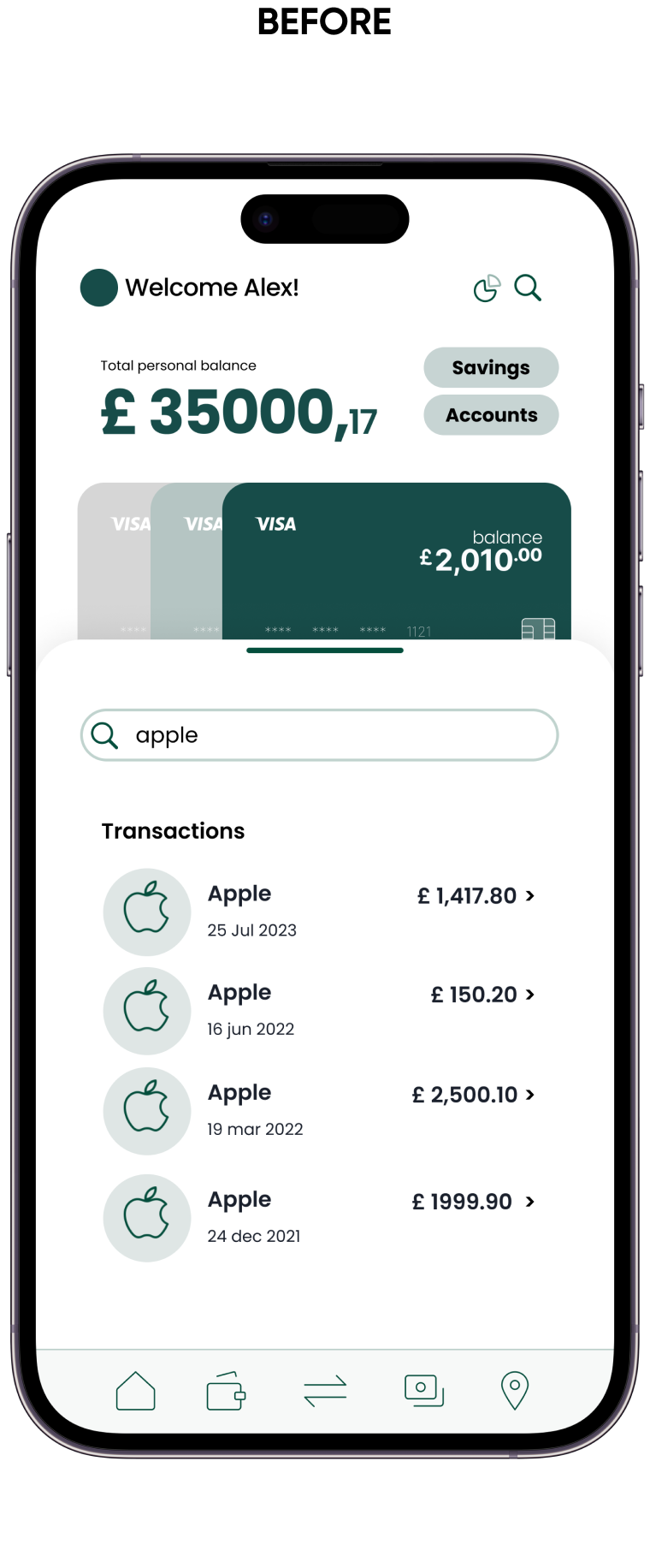

Through 2 rounds of user testing i was able to identify some missed opportunity in the overall user experience.

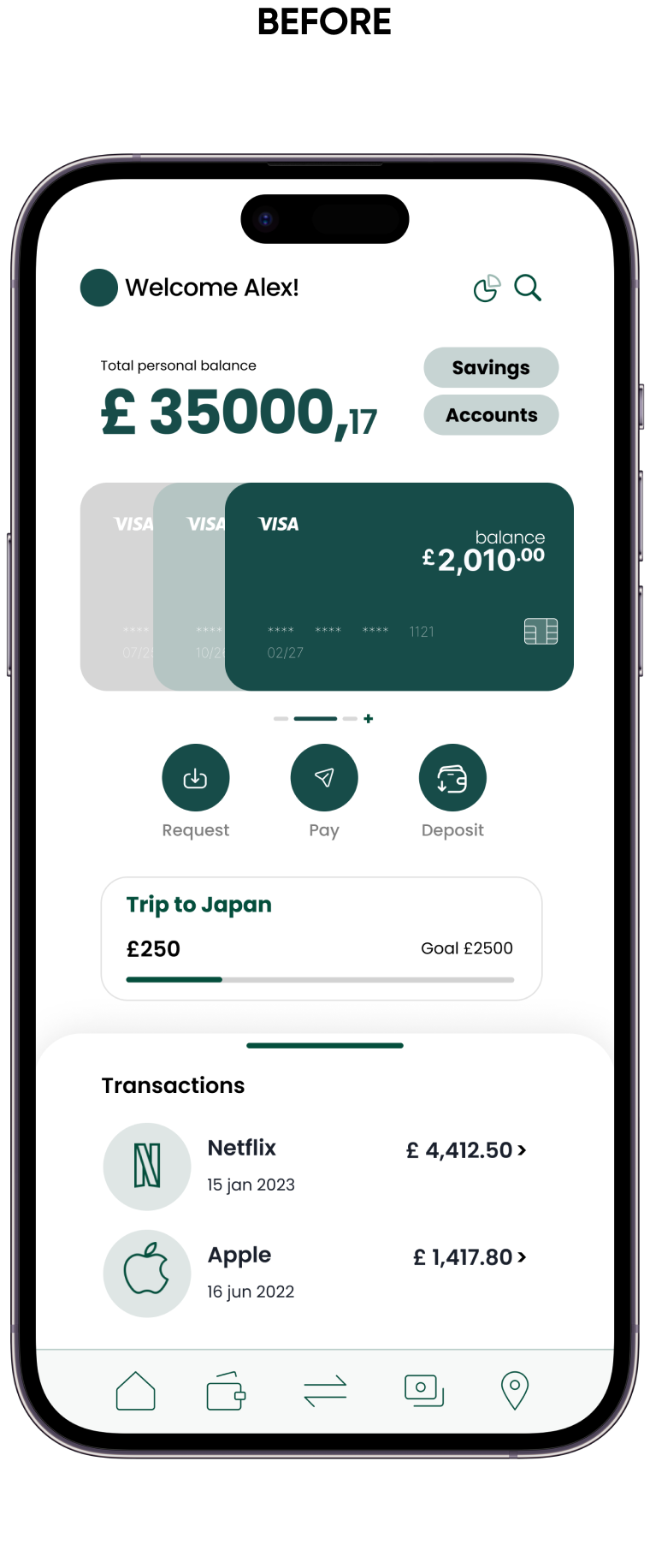

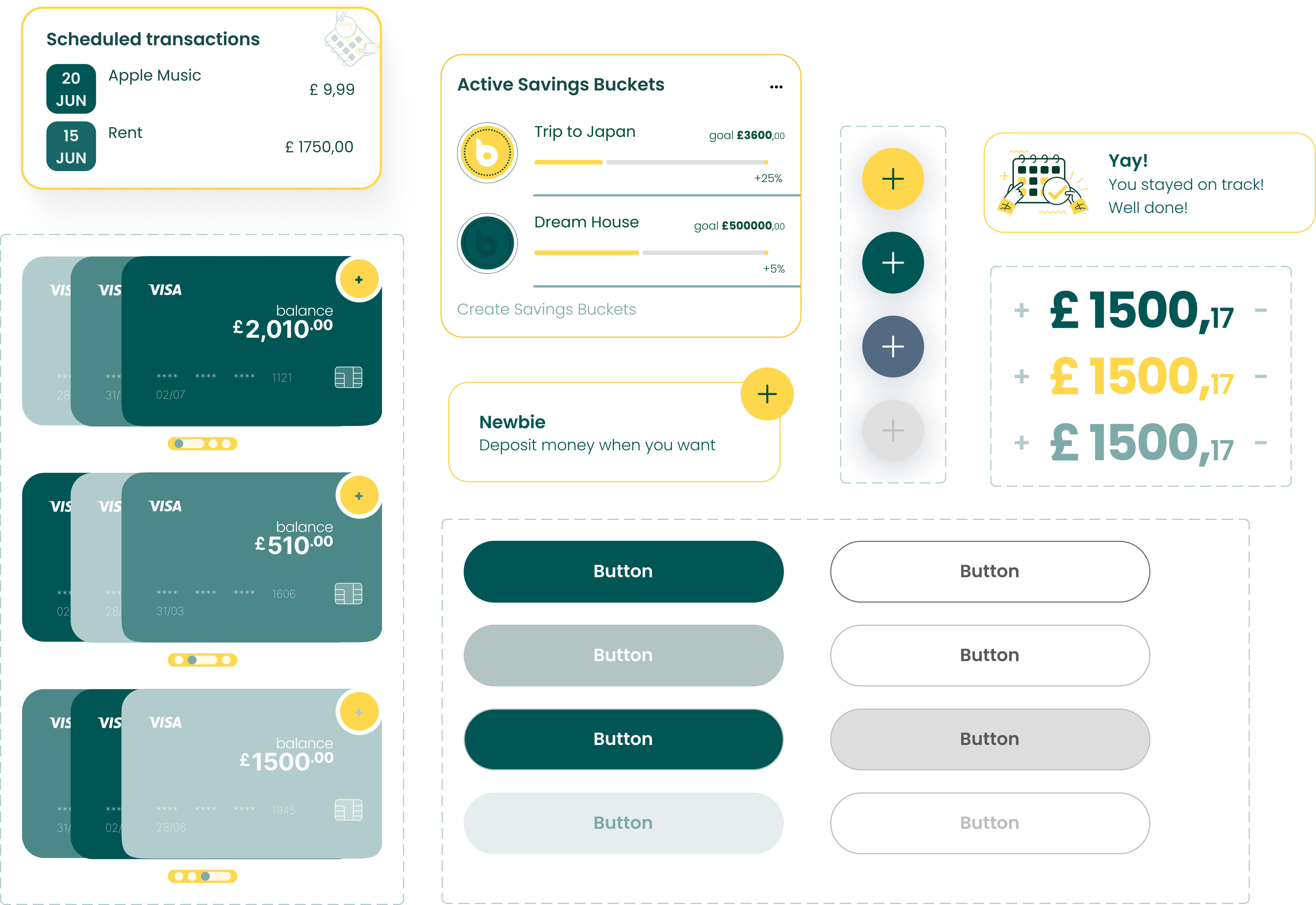

Confusing card management

Users found it challenging to add or remove cards from the dashboard, with some struggling to locate the “+” symbol.

Add Card Visual Cue

The home screen now features a clear call-to-action (CTA) that guides users directly to add a new card to their wallet.

Concise Transaction Display

Users appreciated having transaction access on the dashboard, but feedback indicated that the interface was too cluttered, causing them to lose focus on the transactions quickly.

Simplified Transaction List

Responding to user requests for a simpler transaction overview, I introduced a new screen that allows for easy scrolling through past transactions.

Deliver phase.

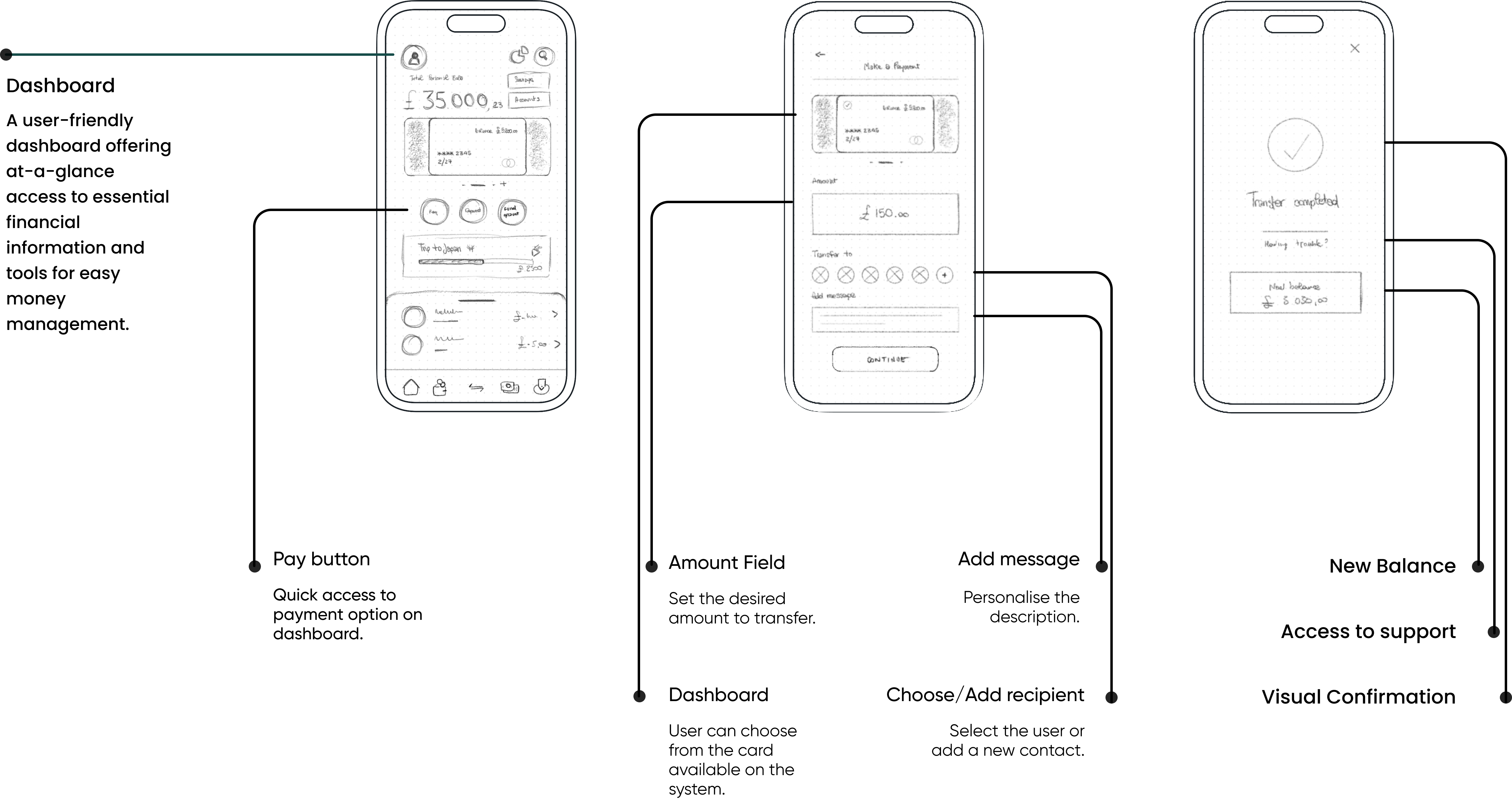

Enhanced Payment Flow

User testing revealed a need for more detailed information throughout the payment process to ensure users feel in control from start to finish. In response, I’ve revised the user flow and added additional screens. Now, the flow includes a clear summary screen before initiating the payment and a visual confirmation screen afterwards to enhance user assurance and clarity.

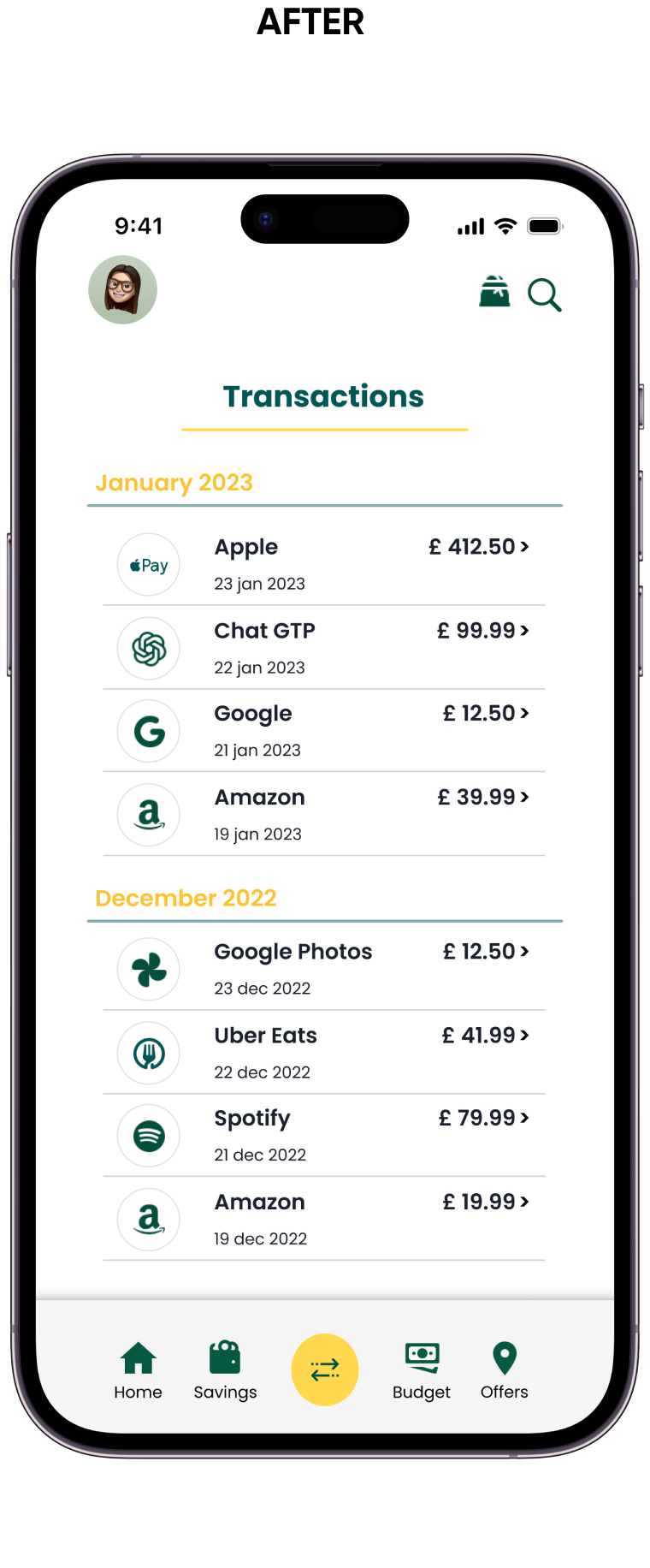

Multi platform.

Optimised Web Payment Flow

Bucky is now accessible via a browser, offering a more comprehensive and secure user experience. The UI has been adapted for larger screens, considering the full range of user experience needs specific to a web interface.

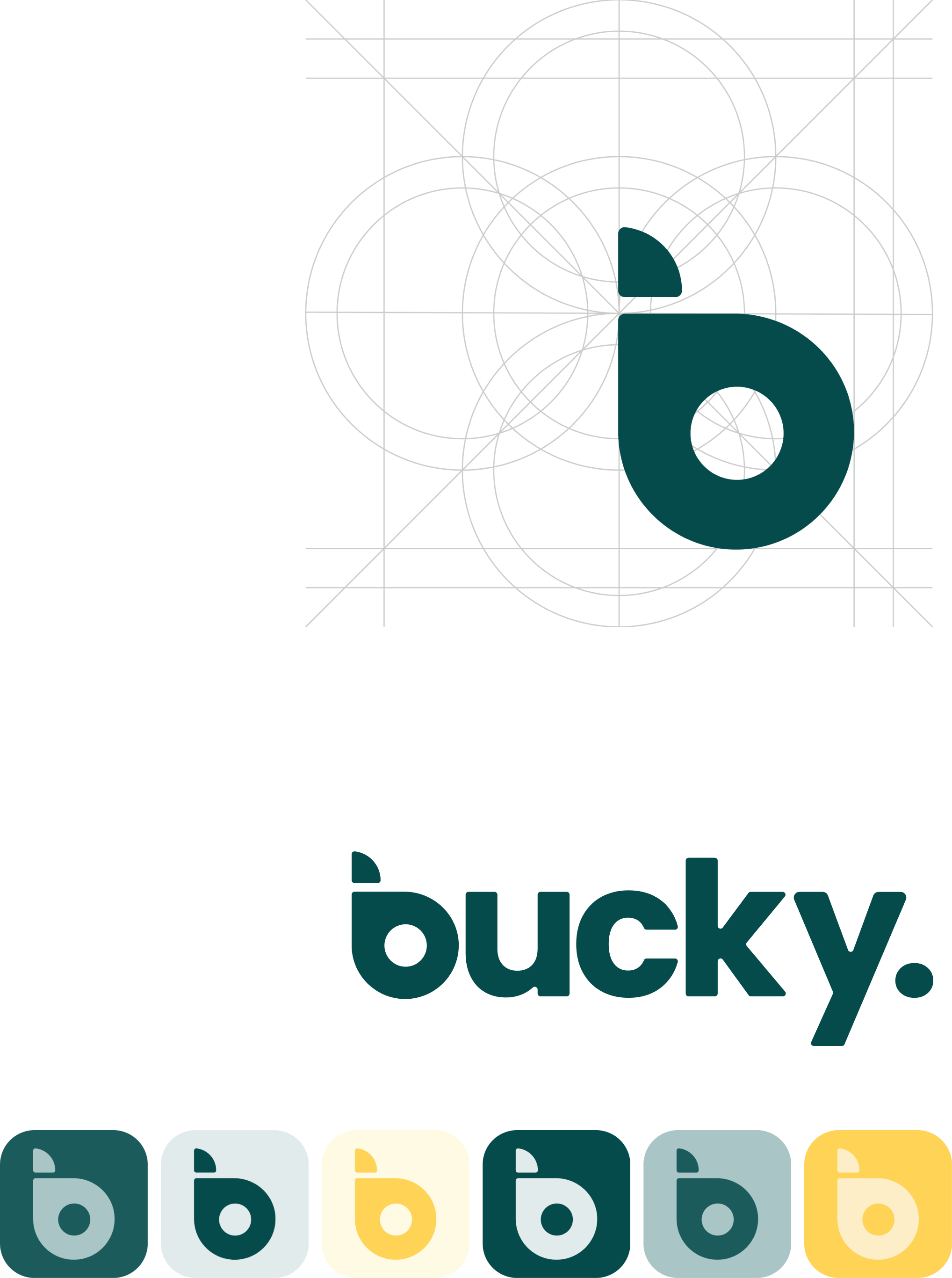

UI Library

The design of Bucky’s visual identity aimed to create an engaging experience that reflects its key features—coins and budgeting.

The logo incorporates the app’s name with a playful touch, using a coin-like dot in the typography to blend financial utility with fun.

Its adaptability to various colour schemes enhances the app’s personalisation, making it more enjoyable and customisable for users.

The Colours

Selecting the colour palette, I opted for hues that inspired positivity and creativity, making the app not just a tool but a space of warmth and encouragement.

Conclusion.

Developing Bucky to this prototype stage has been a journey of discovery, driven by invaluable insights from potential users. Every feature has been meticulously designed and each interaction optimised to meet your financial management needs and simplify your experience.

While I am confident in the robustness of the Bucky prototype as a powerful financial tool, I am also keenly aware that as users engage with it, new needs and insights will emerge. This iterative process is a fundamental part of our design philosophy—Bucky is built to evolve based on user feedback.

I am excited to present this initial version of Bucky, but I am also prepared for the ongoing journey of refinement and enhancement that awaits. Here’s to a future where Bucky continues to adapt and evolve, always striving to meet evolving financial needs. Welcome to the development journey of Bucky, where the final version is always in progress.